Advanced Tax Mitigation

For United States citizens and residents, you can reduce or eliminate state-level income tax on 1) the sale of a privately held company,

2) the sale of a concentrated stock position in a publicly traded company, 3) the sale of real estate, and 4) income and capital gains from a portfolio. You can potentially reduce your Federal tax burden on the same by as much as 30 percent or more. Additionally, you can reduce your estate / gift tax on wealth transfers by as much as 50 percent or more.

For United States citizens who are offshore residents, you can significantly reduce or eliminate the non-US income tax burden and inheritance tax burden on those assets. You need not use some questionable jurisdiction — this all comes with the protections of United States courts.

Seeking certainty and validation, we will typically obtain an advanced ruling from the U.S. Internal Revenue Service regarding the tax character of the innovative structures we create.

Business Valuation & Advisory

We help business owners understand the drivers of firm value and achieve higher financial performance, which ultimately translates into a more successful sale.

.

.

.

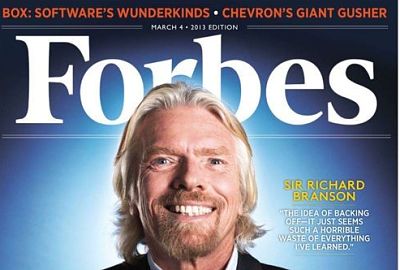

Read Our Forbes Column

Watch Our On-Demand Two-Minute Exit Coach Webinars

To schedule a consultation,

please call us at 866-898-1860.

59 Damonte Ranch Parkway, Suite B 379, Reno, NV 89521

IWC Family Offices helps owners of middle market companies gain control over and understanding of the financial side of their companies via outsourced, part-time CFO services. We help business owners achieve higher financial performance from their firms, which ultimately translates into higher business value upon sale. When the time comes to sell your firm, we help reduce or eliminate state-level income tax, as well as reduce your Federal tax burden by as much as 30 percent or more.